Investment Readiness

Question?

Do you know why startup fails in the investment stage?

Why is a great team with immense potentials not funded by Angels or VC Funds?

Why are entrepreneurs always frightened lest their ideas are not stolen by the big shark?

What you MUST KNOW!

Find what your investors search in your business before they invest!

How you can make your company lucrative to your investors!

How you can protect your million dollar idea!

Key Seven Elements of Investment Readiness

- Team, Talent, Advisor

- Product & Market

- Technology & Operation

- Tractions, Revenue & Growth

- Financial & Performance Management

- Legal Compliance & Admin

- Fundraising

How you can Protect your business IDEA

Your Asset as a Startup Company

- Copyrighted Software, content & product model

- Patented Innovation or Design

- Market Reach with Traction

- Your Brand Image

Tip 1: Get the founding team size right

The founding team has a major influence on most investment decisions. It will often be the first (and if rejected, the last!) thing an investor analyses.It is considered optimum to have 2 or 3 founders. If you have only 1, it is often rejected automatically (despite some data showing it is possible to be successful as a solo founder).

Investors will want to meet the whole founding team and need to be equally impressed. The founding team needs to work well through tough situations. It’s a long-term relationship for 10+ years, so choose wisely. If you don’t get on or like whom you’re working with, change it now! If you aren’t strong collectively, then it’s very likely that you won’t get anywhere together.

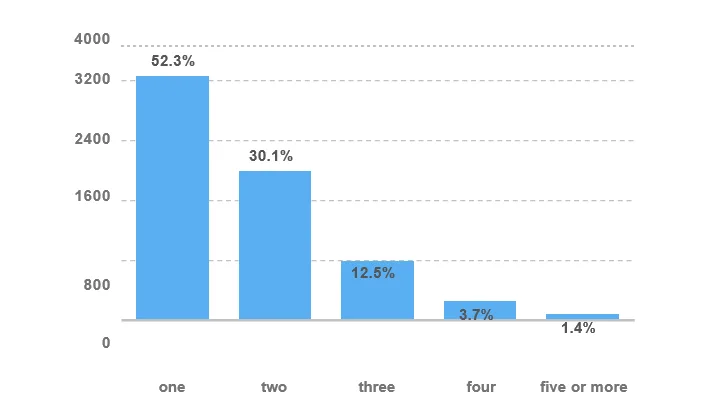

With a complimentary founding team, your startup can be more than the sum of its parts. The number of startups that have secured a successful exit, broken down by the number of founders associated with the company. n=6,191

Tip 2: Make sure the founding team is complementary

Investors will want to meet the whole founding team and need to be equally impressed. The founding team needs to work well through tough situations. It’s a long-term relationship for 10+ years, so choose wisely. If you don’t get on or like whom you’re working with, change it now! If you aren’t strong collectively, then it’s very likely that you won’t get anywhere together.

With a complimentary founding team, your startup can be more than the sum of its parts

Tip 3: Show your commitment

More than sweat equity, investors expect that you have invested your own funds into your business. The value will depend on each startup’s situation. When you seek to raise external capital, founders & C-suite members will need to be 100% committed.

Tip 4: Be aware of and work on your Emotional Intelligence (EQ or EI)

The CEO will receive extra scrutiny from potential investors and their expectations will be high. Various soft skills and other subjective factors such as “emotional intelligence” will play a key role in the investment decision.

Investors will consider things such as:

• Self-awareness (knowing own strengths/weaknesses)

• Coachability, asking questions, taking feedback and learnings

• Staying cool under pressure

• Passion that is contagious and motivates people to follow

• Persistence with willingness to adapt and pivot

• The right mix of ambition and ego and teamplayer skills

If you are interested in learning more about emotional intelligence, dive in the link:

https://www.themuse.com/advice/10-behaviors-make-great-google-manager

Tip 5: Gather as much startup and sector experience in the team

Many entrepreneurs starts from point 0. Being successful at the first attempt is possible. However, prior startup and sector experience can be valuable and are always highly appreciated. The startup and sector experience can come in the form

of co-founders, advisors and/or investors.

Are you curious to know what are the available fund raising platform for the startups?

Do you know what are the 30 legal services that a startup might need to carry on their new business?