Investment Readiness

Question?

Do you know why startup fails in the investment stage?

Why is a great team with immense potentials not funded by Angels or VC Funds?

Why are entrepreneurs always frightened lest their ideas are not stolen by the big shark?

What you MUST KNOW!

Find what your investors search in your business before they invest!

How you can make your company lucrative to your investors!

How you can protect your million dollar idea!

Key Seven Elements of Investment Readiness

- Team, Talent, Advisor

- Product & Market

- Technology & Operation

- Tractions, Revenue & Growth

- Financial & Performance Management

- Legal Compliance & Admin

- Fundraising

How you can Protect your business IDEA

Your Asset as a Startup Company

- Copyrighted Software, content & product model

- Patented Innovation or Design

- Market Reach with Traction

- Your Brand Image

Tip 20: Be careful with your equity

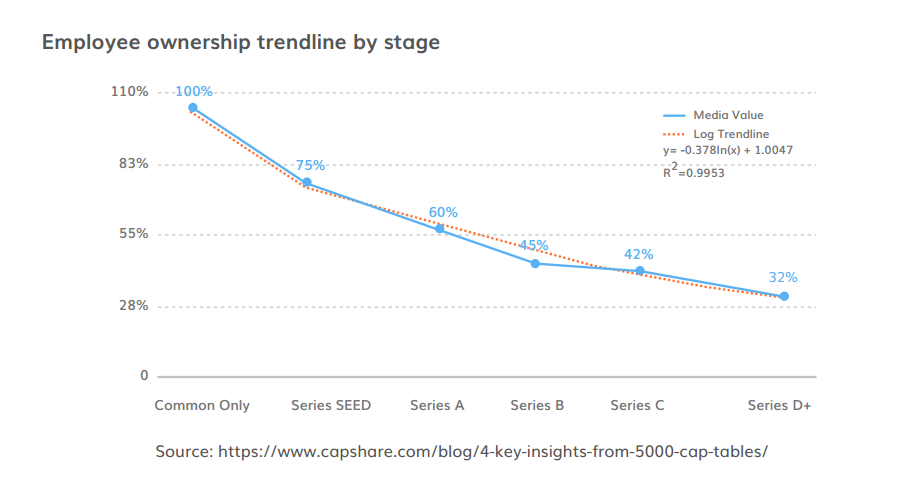

Don’t give away too much equity early on. Losing 50% of equity before your seed round is not advisable. You need to keep your cap table clean by tracking the terms, dates, amount and the dilution.

Check out our cap table template: Click Here>

Tip 21: Develop a fundraising strategy

Investing is full of uncertainty. Your funding needs and round should be communicated with certainty or it won’t close.

So, you need to develop a fundraising strategy based in How much (Terms), Why (For a clear milestone and use of funds) and Who (Types of investors and your pipeline of potential leads).

Terms

• How much & currency

• Type (Grant, Convertible Debt/note, Equity, Debt Financing)

• Valuation / Cap / Discount

Why are you raising

• Funding should be for a clear milestone you aim to achieve

• Usage of funding should be clearly budgeted/known

Lead investor

• A lead investor does the hard work so other investors can follow

• Without a lead, closing a round can be challenging at early stage (angel/seed) and impossible at a later stage (series A onwards)

Lead Investor targets

• Like sales, fundraising has a certain conversion/success rate

• Build and manage your investor pipeline

• Target the right profiles depending on the round

Tip 22: Have a high-quality pitch deck

“Just send me your deck”…the infamous words some investors will say to you. Make it worthwhile for them to open it. Also, have the pitch deck ready beforehand, so you can send it quickly. They will “judge a book by its cover”.

To have a high-quality pitch deck, don’t reinvent the wheel! Use tried and tested formats and have the material (i.e. data room) ready to back up the deck.

Here is a table with the expected content in a pitch deck:

Tip 23: Having a credible amount of traction is the MUST!

Traction means having a measurable set of customers or users that serves to prove to a potential investor that your startup is “going places.” The tricky part is actually gaining that traction and knowing when you have enough to approach potential investors, so here are a few tips that should help.

There might be so many verticals for getting traction for your startup. Depending on the target market & potentials, the startup may follow the given verticals:

| Publishing on Journals/Newspaper | Non-SEM Online Ads | Target Market Blog |

| Public Relationship/Publicity Stunts | Search Engine Optimization | Community Building |

| Search Engine Marketing (SEM) | Partnering with Companies | Viral Thread Marketing |

| Participating at the Trade Shows | Speaking Engagement | Sales on Existing Platform |

| Offline Ads (Billboard/wall painting etc.) | Buying Smaller Sites | Anything that drag attention to your target audience |

Conclusion

These tips give you some orientations how to get ready for investment. One last advice: in fundraising, it takes time to get everything ready. Prepare really well before contacting an investor.

We can support you in this mission with our Investment Readiness Program. We scout for the best tech startups to mentor and connect them to investors, while also investing in them ourselves. We walk the talk. Join the program and see how can your startup improve its performance and get ready to secure investment.

• Get investment faster by knowing where to spend your time and energy when preparing for your first investment round.

• Learn how to create a fundraising strategy and how to pitch what investors are looking for.

• Benchmark globally by learning the best practices. Challenge our global team of experts with your questions!

• Get introduced to investors from around the globe specialised in tech startups

Page 1 Page 2 Page 3 Page 4 Page 5

Are you curious to know what are the available fund raising platform for the startups?

Do you know what are the 30 legal services that a startup might need to carry on their new business?