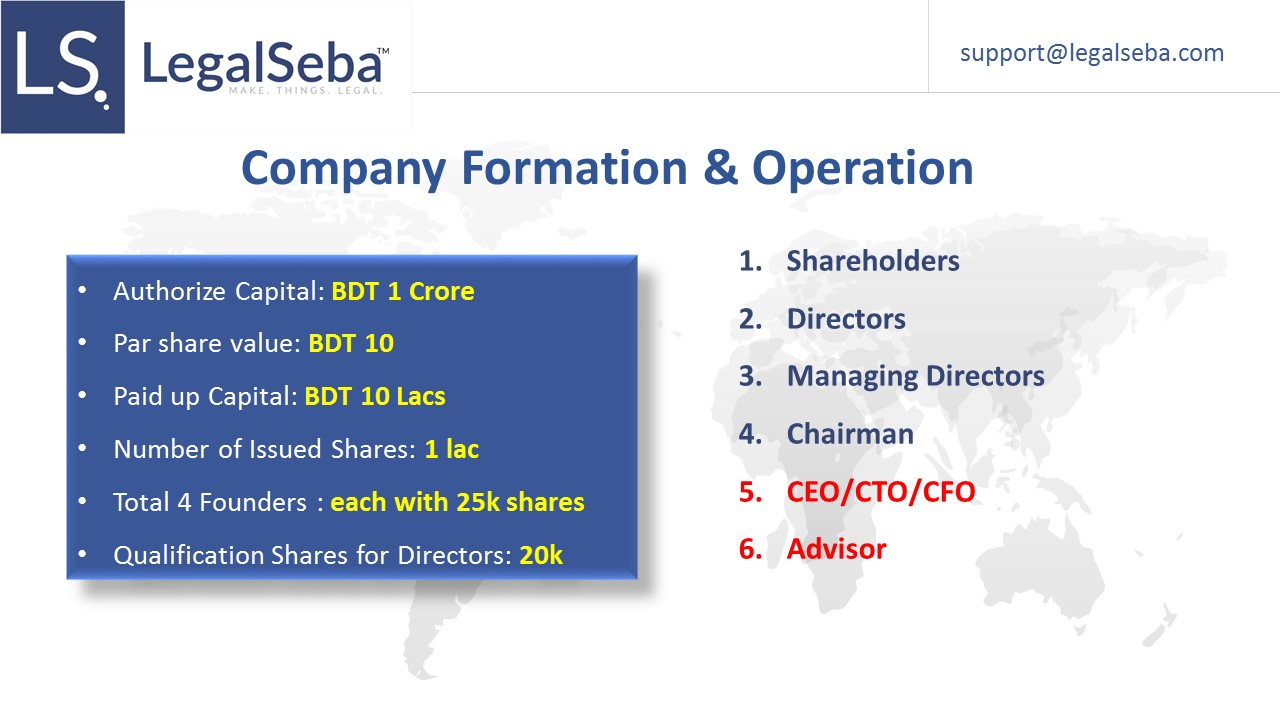

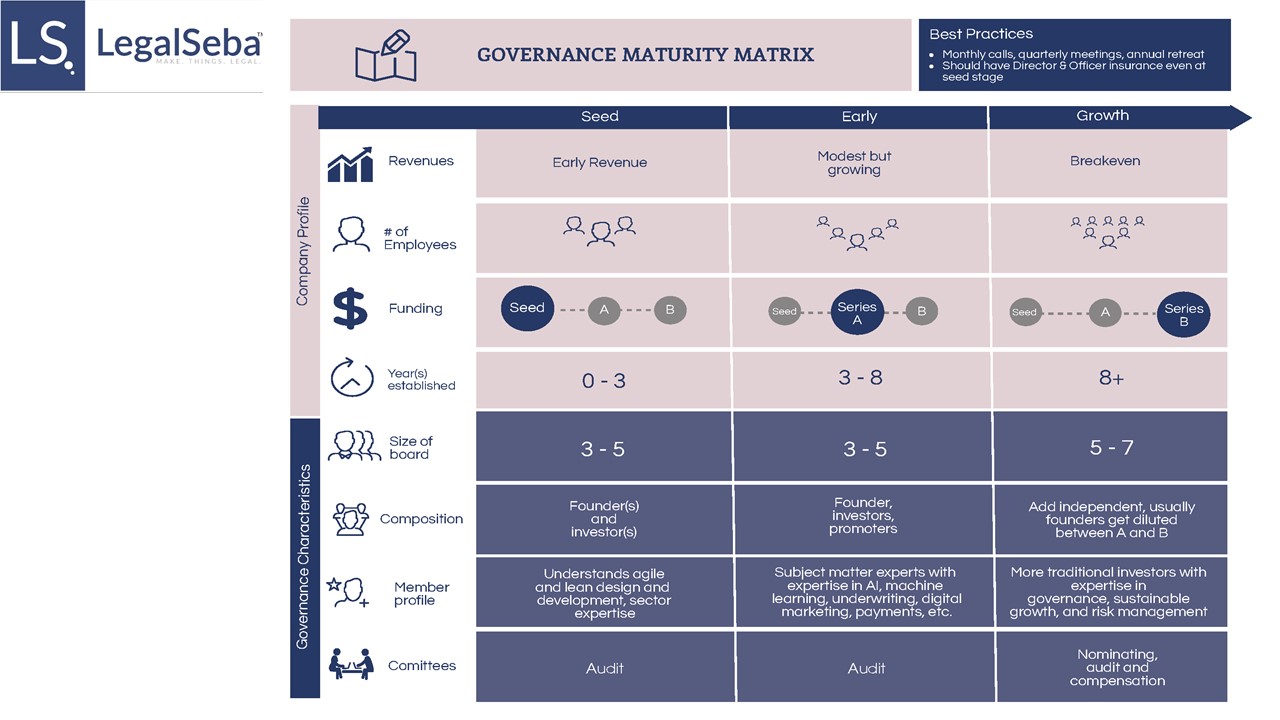

- Entity Formation

- Services

- Foreign Investment

- Entry Option in Bangladesh

- Incorporation Packages

- Work Permit in Bangladesh

- Double Taxation Policy

- Transfer Pricing Policy

- Exit Option for Foreigners

- Foreign Joint Venture Operation

- Funds Repatriation by Non-residents

- FDI Legal Procedural Guide

- Non-Resident’s Property Investment

- FDI Facilities in BD

- Resources

- Client Login

- Start Now

Select Page