Season One

6.00 – What is a Startup? ➤

8.50 – When Should I incorporate ➤

12.00 – Types of business entities in Bangladesh ➤

13.00 – Business incorporation process in Bangladesh ➤

18.00 – Bank Account Opening Checklist ➤

20.00 – Company Operation & Board Maintenance ➤

24.00 – Intellectual Property & the Protections ➤

26.14 – Fundraising Mechanics for Startups ➤

30.00 – Difference between SAFE & Convertible Notes ➤

37.00 – Parameter to determine the company valuation ➤

40.00 – Audit & Compliance in Bangladesh ➤

43.30 – Incorporating a company in Delaware, USA ➤

47.00 – Incorporating a company in Singapore ➤

49.25 – Corporate Governance for Startups ➤

57.00 – Exit Policy ➤

63.00 – Fundraising Knowledge Sharing with the CEO of Gaze ➤

96.00 – Question & Answer ➤

E-commerce & Compliance:

Season 2:

Season One 2020

Season Two 2021

What is a Startup?

➤ Started by 2-5 founders

➤ Developing a profit-generating/viable product, services or platform

➤ Usually, it’s driven by innovation or a business model with a potentiality to scale rapidly

➤ Create an impact on the concerned industry

➤ It may solve a problem or add an extra value to the existing product or services

When should we incorporate?

Different Stages of the business

1. Research Stage

2. Prototype Stage

3. Testing Stage

4. Revenue Generating Stage

5. Growth Stage

Legal Mechanics for the beginning

1. Founders’ Agreement with vesting share option

2. Vendor/Promoter Agreement

2. IP Assignment Agreement

3. NDA

4. Sole Proprietor/Partnership/Limited Company

Types of business entities in Bangladesh

| Parameter | Sole Proprietor | Partnership | Limited Company |

|---|---|---|---|

| Ownership | Single Owner | Minimum two owners | More than two Shareholders |

| Taxation | Tax Free up to BDT 3 lacs | Tax Free up to BDT 3 lacs | Corporate Tax at 27.5% |

| Investment Policy | Loan or Profit sharing financing | Loan or Profit sharing financing | Equity Investment/Loan/Profit sharing financing |

| Liability | Proprietor shall be liable | Partners Shal be liable | Company Shall be liable |

| Nationality | Bangladeshi | Bangladeshi | Any national or body corporate |

Business incorporation process in Bangladesh

| Sole Proprietor | Partnership | Limited Company |

|---|---|---|

| NID Card & Photos | NID Card, TIN & Photos | NID Card, TIN & Photos |

| Rent Agreement with Landlord | Partnership Deed on BDT 2000 Stamp | Memorandum & Constitution of the company |

| Declaration as a commercial space from the relevant authority (in some cases) &/ Electricity Bill copy | Rent Agreement with the Landlord | Form IX (Consent letter of the directors) |

| Authority: City Corporation /Municipality/ Union Parishad | Authority: Registrar of Joint Stock Companies And Firms | Authority: Registrar of Joint Stock Companies And Firms |

| Obtain Trade License in the name of the business with above documents | Obtain Trade License in the name of the Firm | Obtain Trade License in the name of the company from relevant authority |

Bank Account Opening Checklist

| Sole Proprietor | Partnership | Limited Company |

|---|---|---|

| Trade License | Trade License | Trade License |

| Photos, NIDs & TIN of the Proprietor | RJSC Incorporation Certificate/Notarized Partnership Agreement | Company Incorporation Certificate |

| Rent Agreement in the name of the company | Board meeting resolution | AOA & MOA of the company |

| Electrify Bill of the rented Place | Photos, NIDs & TIN of the Partners | Board Resolution |

| Declaration as a commercial space from the relevant authority (in some cases) | Rent Agreement in the name of the company | Photos, NIDs & TIN of the Directors |

| Electrify Bill Copy of the rented Place | Rent Agreement in the name of the company | |

| Partnership Firm TIN Number | Electrify Bill Copy of the rented Place | |

| Company TIN Number |

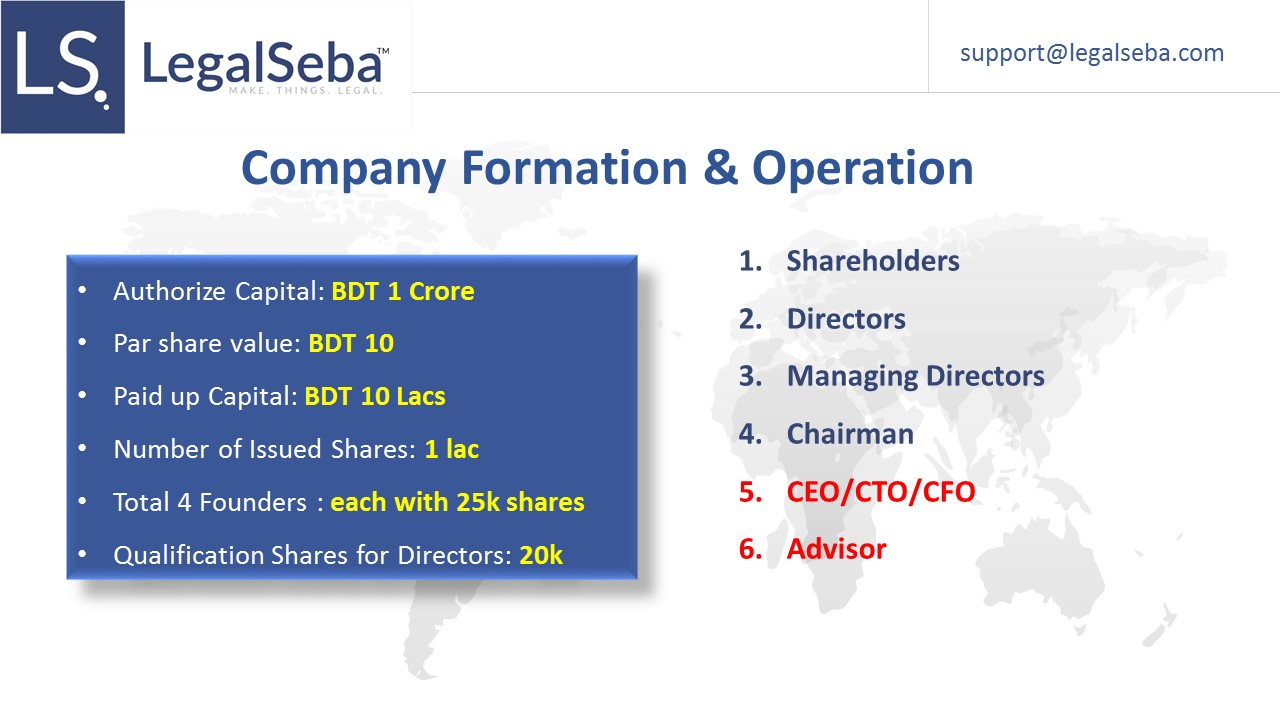

Company Operation & Board Maintanance

Intellectual Property & the Protections

Assets of a Startup Company

- Software, web contents & web/mobile apps

- Researched Innovation or Design

- Customer Leads

- Hard-earned Brand Name

Why a company must protect them?

- The company is publishing things on public domain

- Anyone can copy them

- Customize them to their own

- Claim them as their own assets

- Use your brand image for their sales

- Your Investor may not feel comfortable to invest

- Those assets must be registered to tag them in your Company Valuation

Example of Specific IPs

Patentable Items:

Business methods, Computer software, Computer hardware, Computer accessories, Games, Jewelry, Machines, Magic tricks, Musical instruments, Plants, Sporting Goods

Copyrightable Items:

Literary works, Software works, Musical works, Dramatic works, Choreographic works, Pictorial, graphic, and sculptural works, Motion pictures and other audiovisual works, Sound recordings, Architectural works

Trademarkable Items:

Brand name of the Company, Slogan, Product Name, Service Names, Brand Logo/Symbol

Fundraising Mechanics for Startups

Instruments

a. Loan/Debenture Agreement

b. Convertible Note

c. Simple Agreement for Future Equity (SAFE)

d. Equity Financing (Share Purchase)

e. Issuing Redeemable Preference Shares

f. Investment Term Sheet/ Share Subscription Agreement

Source of Funding

1. Bootstrapping (Friends & Family)

2. Crowdfunding

3. Angel Investors (Individual Person)

4. Business Incubators & Accelerators

5. Bank Loans

6. Micro Finance

7. Government Subsidies

8. Venture Capital

Difference between SAFE & Convertible Notes

| Parameter | SAFE | Convertible Notes |

|---|---|---|

| Interest | No interest | Set an interest rate |

| Qualified Financing/Trigger Event | At a fixed Valuation At any equity financing event | Any equity financing event At a valuation |

| Maturity | No Maturity Period | Set A maturity period |

| Company Valuation | Not Required | Not required |

| Discount Option | Can set Discount Option | Can set Discount Option |

Common parameter to determine the company valuation

An investor is willing to pay more for your company if:

1. The company represents a HOT Sector

2. The company has a Team with industry expertise

3. The company has a Functioning product

4. The company has Proven tractions

5. The company is First Mover of that industry

An investor is less likely to pay a high premium over the average for your company if:

1. The company represents a Poorly performed sector

2. The company is Highly commoditized, with little profit margins

3. The company has a Large Set of Competitors

4. The company management team has no working experience and/or maybe missing key people

5. The company product is not working and/or the company no customer validation.

6. The company is shortly going to run out of cash

Audit & Compliance in Bangladesh

Annual Filing for Sole Proprietorship/Partnership/Limited Company:

1. City Corporation (Business Trade License)

2. Company House (RJSC)

a. Financial Audit Report

b. Annual Company Report Fillings

c. Filling Regular Corporate Amendments

3. Tax Office (NBR)

- Company Tax Return

- Witholding Tax Return

- VAT Return Submission

4. Other Business Licenses/Approvals

a. Export/Import

b. BSTI, Environment, Fire, Bond, Travel etc

Other Required Audit as per the nature of company

- Company Law Audit

- Labour Law Audit

- Tax Law Audit

- Annual Due Diligence

- Technical Audit

- IP Audit

- Industrial Audit

For the Startups & High Growth Companies

1. Financial Projection Preparation

2. Monthly Performance Report for the Investors

4. Monthly & Quarterly Financial Statement

5. Annual Financial Audited Report

Incorporating a company in Delaware, USA

Requirements:

1. Minimum One Shareholder

2. Minimum 1 share

3. Registered Agent

Incorporation Benefits

Less Yearly Maintenance Cost

Issuing SAFE & Convertible Note Facility

Vesting Share Issuance Facility

Common & Preferred Stock Facility

Shareholders details are protected

No restriction on Foreign Investment

Tax Benefits

- Corporate Tax Rate: 8.7% Delaware + US Federal Tax

- Personal income tax rate: 10%-37%

- LLCs, limited partnerships, General Partnerships = $300 (Annually fee)

- Corporation Franchise Tax: $400 (minimum)

- Profit from Holding company (no double taxation burden)

- Corporate Tax Exemption facilities for out of shore operating companies

- Dividend & Capital Gains are subject to tax

Company Bank Account Opening being a Non-Resident

The following banks usually offers online bank account opening for the non-residents once they form their business entity in USA

| Chase | Mercury | |

| Online applications available | In some cases, for single member LLCs only | Yes |

| Ongoing fees | 15 USD – 95 USD/month depending on plan | 0 USD -350 USD/month depending on plan |

| Wire transfer fees | 0 USD – 5 USD for online international transfers – currency conversion fees may apply 15 USD incoming wire fee | No Mercury fees – currency conversion costs 1% Third party costs may apply |

| Card fees | 3 USD – 5 USD out of network ATM fee 3% foreign transaction fee | No Mercury fees for spending and withdrawals, either in the US or abroad Third party costs – such as ATM operator fees – may apply |

| Important features | Monthly fees can be waived by meeting eligibility criteria Accounts feature some free transactions monthly Accept customer card payments Savings accounts also available – fees may be waived for checking account holders | Features include bill pay, invoicing and ways to take card payments Working capital available for customers Multi-user access, third party integrations and other handy features offered Savings accounts also available |

Incorporating a company in Singapore

Requirements:

1. Minimum One Shareholder

2. Minimum 1 share

3. One local director

4. One Local Registered Address

5. One Company Secretary

Incorporation Benefits

1 day incorporation facility

Global payment gateway in the name of your company

Issuing SAFE & Convertible Note Facility

Vesting Share Issuance Facility

Common & Preferred Stock Facility

No restriction on Foreign Investment

Corporate Tax Rate: 17%

No Audited Report required if the annual revenue falls below S$ 10 million.

Tax Exemption on

- Foreign-sourced dividends

- Foreign branch profits

- Foreign-sourced service income

- No Tax on Dividends

Tax exemption for new startups

1. 75% tax exemption on the first S$100,000 of taxable income and

2. 50% exemption on the next S$100,000 of taxable income

Company Bank Account Opening being a Non-Resident

The following banks usually offer online bank account openings for non-residents once they form their business entity in sINGAPORE

| Chase | Mercury | |

| Online applications available | In some cases, for single member LLCs only | Yes |

| Ongoing fees | 15 USD – 95 USD/month depending on plan | 0 USD -350 USD/month depending on plan |

| Wire transfer fees | 0 USD – 5 USD for online international transfers – currency conversion fees may apply 15 USD incoming wire fee | No Mercury fees – currency conversion costs 1% Third party costs may apply |

| Card fees | 3 USD – 5 USD out of network ATM fee 3% foreign transaction fee | No Mercury fees for spending and withdrawals, either in the US or abroad Third party costs – such as ATM operator fees – may apply |

| Important features | Monthly fees can be waived by meeting eligibility criteria Accounts feature some free transactions monthly Accept customer card payments Savings accounts also available – fees may be waived for checking account holders | Features include bill pay, invoicing and ways to take card payments Working capital available for customers Multi-user access, third party integrations and other handy features offered Savings accounts also available |

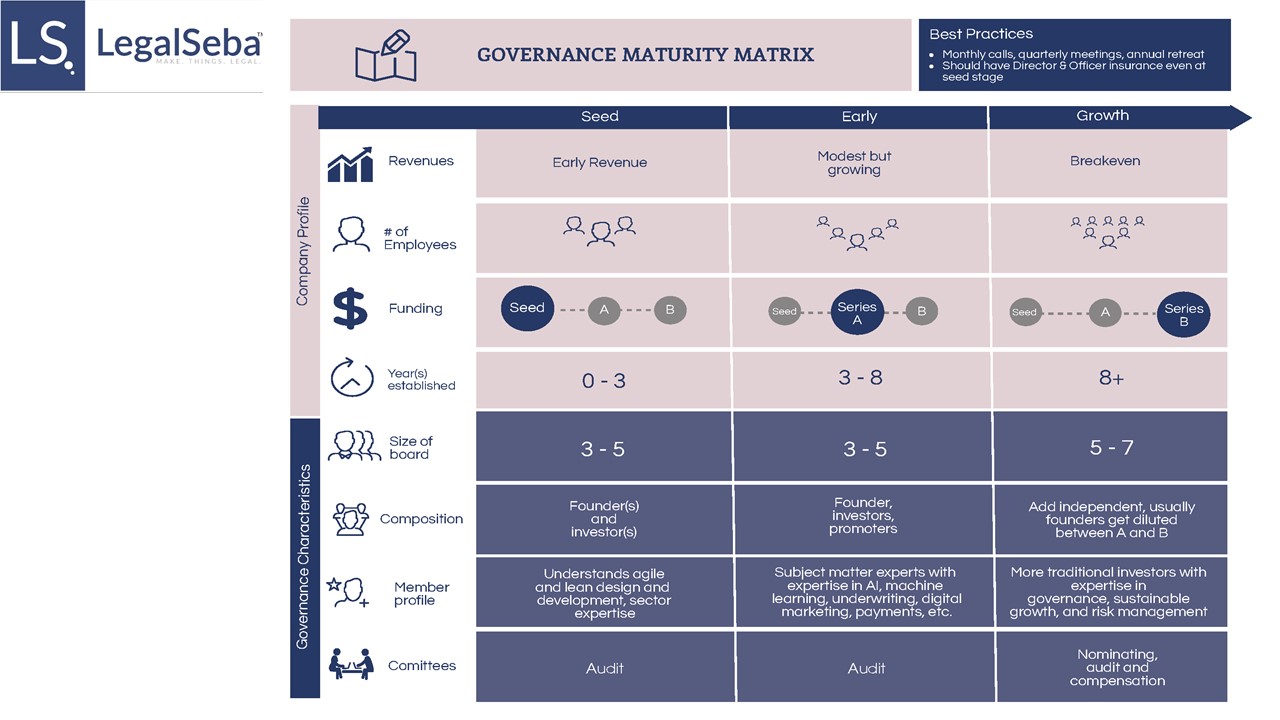

Corporate Governance for Startups

Why Corporate Governance for Startups

- To ensure that the proper controls & processes are in place to adopt rapid growth.

- Governance practices should be in-line with investor expectations throughout the life-cycle of a company

- To mitigate the communication gap among the Investors, founders & employees of the company.

- Governance improves transparency, particularly if there are strong founders in the business

- To align the vision of the company with customer satisfaction

- To figure out the weakness & strength of the management.

- To Ensure board diversity and independence implementing check & balance mechanism.

Key Corporate Governance Practices

- Board members must show up being prepared and must engage with the work

- Understand that early-stage company boards are different from mature company boards.

- The expectation of the board members should be clear from the beginning.

- Having an organized board committee too early is not recommended.

- Having the right kind of experience on the board is the key.

- Board members should have a passion for impact and be aligned with the company values.

- Succession Plan for the several departments

- Add independent board members as the company grows

- Forming Financial Projection & Risk Analysis committee

Exit Policy

Startups looking for angel investors or venture capital (VC) absolutely need an exit strategy because investors require it. The exit is what gives them a return.

Exit strategies related to startup funding are quite often misunderstood: The “exit” in exit strategy is for the money, not the startup founders or small business owners. The company brings in money and the investors get money out.

The founders can also take an exit in the long run through several processes.

Several Exit Mechanism for the Founders & the Investors

1. Selling Equity

2. Merger & Acquisition (M&A)

3. Acqui-hires (The Startup is closed and the talent remain under contract)

4. IPO (Initial Public Offering)

5. Selling intellectual Property or giving license to the IP (Intellectual Property)

6. Bootstrapping the Company (Startups give Dividend)